Short-term interest only rehab loans for 5+ unit multifamily properties.

|

|

Multifamily Bridge Loan

|

|---|---|

Minimum Guarantor Fico | Mid-Score of 680 |

Markets | Primary, secondary and tertiary |

Loan Term | 12 to 24 months |

Recourse | Loans ≤ $2MM: Full Recourse Loans > $2MM: Full Recourse or Limited Recourse with bad-boy carveouts Completion Guaranty/Reserve Replenishment Guaranty when applicable |

Loan Types | Interest Only | Fixed/Adjustable Rate Mortgage Options |

Experience | Prior multifamily property ownership experience required |

Loan Amount | $500K - $5MM |

Loan Purpose | Multifamily bridge loans for purchase or refi of small and middle-market investment properties (5+ multifamily units) that are stabilized or in need of renovation/value-add. |

Property Type | 5+ unit Multifamily, min $35,000 per door Acceptable properties are Class A, B and C grade. Class D properties will be considered on a case-by-case basis |

Maximum Leverage Loan-To-Cost (Ltc) Loan-To-Value (Ltv) Cost Is Purchase Price Amount | Up to 75% of purchase price and 100% of renovation costs subject to 80% total (LTC) | 70% of stabilized value (LTV) Cash-out refi 65% |

Borrower Recourse | Recourse and Non-recourse. Non-recourse option will have standard carve-outs; availability will be determined on a case-by-case basis. |

Foreign Nationals | Allowed with established US credit subject to 55% stabilized LTV max |

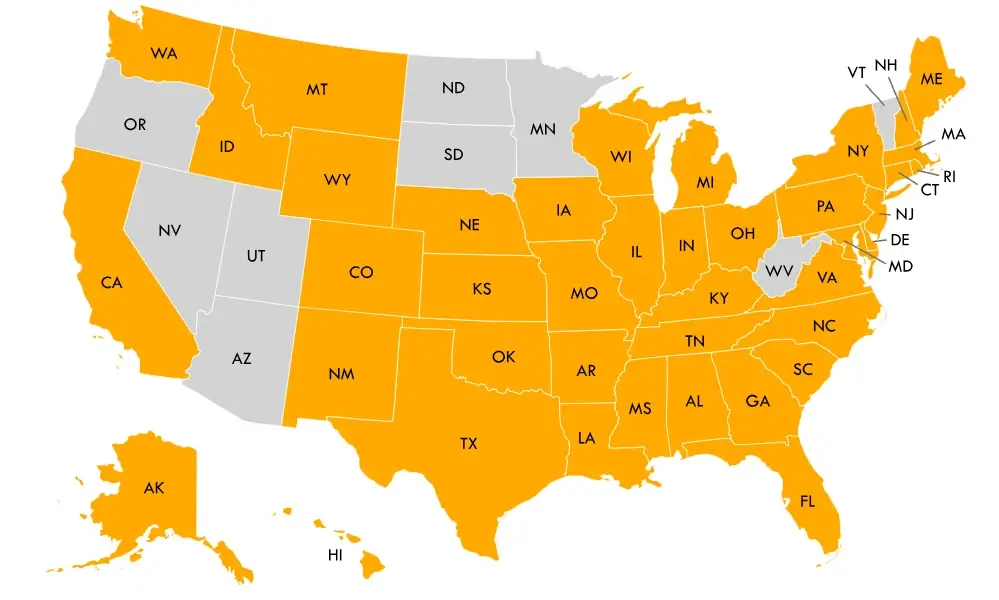

DISCLAIMER: Programs not available in the following states: Arizona, Minnesota, Nevada, North Dakota, Oregon, South Dakota, Utah, Vermont and West Virginia. All information contained herein is for informational purposes only and, while every effort has been made to insure accuracy, no guarantee is expressed or implied. Any programs shown do not demonstrate all options or pricing structures. Rates, terms, programs and underwriting policies subject to change without notice. This is not an offer to extend credit or a commitment to lend. All loans subject to underwriting approval.